IIT GATE Economics Coaching 2025

MA Economics Entrance Preparation

Join 1,000+ EDUSURE Students Who Excelled in IIT GATE Economics!

If you’re targeting CUET PG Economics and similar exams, our CUET Plus Course is the ideal choice for you!

IIT GATE Economics Coaching by EduSure

IIT GATE Economics Coaching

Course Features

- Microeconomics, Mathematics, and Statistics lectures by Samkith Sir (ISI MSQE).

- Macroeconomics lectures by Mahima Ma'am (DSE, SRCC).

- Specialized content on the Indian economy curated by EduSure.

- Weekly general knowledge quizzes and resources from EduSure.

- User-friendly EduSure student portal for easy navigation.

- Access to complete class recordings via EduSure.

- Topic-specific question categorization for focused practice.

- Previous Year Question (PYQ) solutions sorted by topic and year for ISI, DSE, IIT, CUET, IIFT, SAU, UOH, and more.

- PDF notes available for all subjects.

- Weekly tests after each topic to gauge understanding.

- Additional practice questions for all topics.

- 10 IIT mock tests and 5 ISI mock tests, Ashoka, and SNU mock test

- 10 CUET mock tests, mocks on IIFT, MSE, SAU, APU, and more.

- Live mock tests conducted throughout the year.

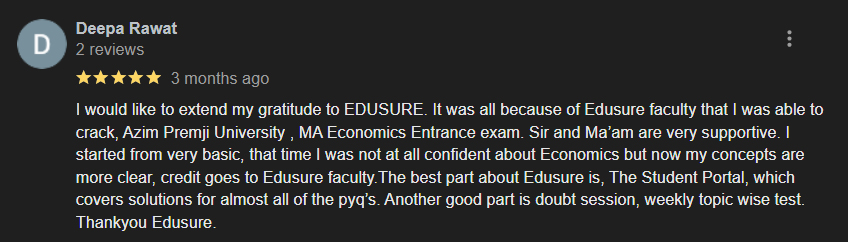

- Unlimited doubt resolution support.

- Benefits of being part of the EduSure cohort.

- Sunday motivation and guidance sessions with Mahima Ma’am or Samkith Sir.

- 24/7 portal helpdesk assistance.

24/7 Access on Student Portal

Latest Lectures on the Indian Economy

Unlimited Doubt Sessions

Access till 30th June of the coming year

Click the button below to view all the MA Economics Colleges and their respective details

IIT GATE Economics Coaching by EduSure

Econometrics CLRM Basics

Indian Economy - Agriculture Overview

National Income Accounting- Macro Economics

Mathematics - Functions Basic Theory

Micro Economics - Budget Line Basics

Statistics - Central Tendency

Get 1 FREE IIT GATE MOCK Test by EduSure!

Click on the link below to schedule a Free Mock Test.

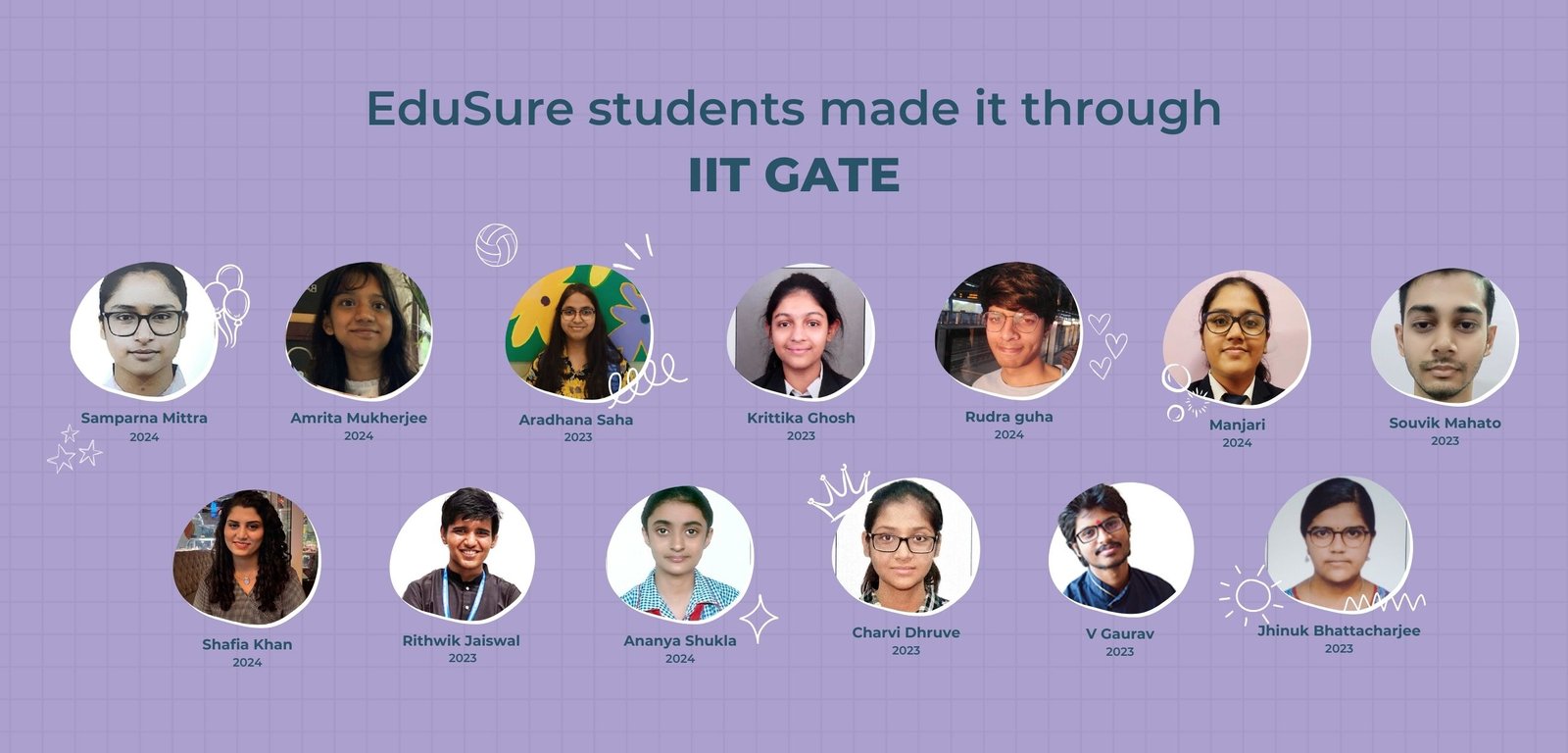

IIT GATE Past Results

Explore the Achievements of Our Students in IIT JAM, IIT GATE, ISI, and Top MA Economics Programs: Click the button below

MA Eco Course Syllabus

IIT GATE Economics Syllabus for XH-B1 (Reasoning and Comprehension): |

This section assesses candidates’ ability to understand and interpret written information, crucial skills for research in Humanities and Social Sciences. It emphasizes critical reasoning and text analysis rather than language competence, similar to exams like LSAT, GRE, and GMAT. Questions include reading comprehension, expression, analytical reasoning, and logical reasoning. |

XH-C1 |

Economics |

C1.1 Microeconomics: |

Theory of Consumer Behaviour: Cardinal Approach and Ordinal Approach; Consumer Preferences; Nature of the utility function; Marshallian and Hicksian demand functions; Duality Theorem. Slutsky equation and Comparative Statics. Homogeneous and Homothetic Utility Functions; Euler’s Theorem. The Theory of Revealed Preference: Weak Axiom of Revealed Preference and Strong Axiom of Revealed Preference, Theory of Production and Costs: Short-run and Long-run Analysis, Existence, Uniqueness and Stability of Market Equilibrium: Walrasian and Marshallian Stability Analysis. The Cobweb Model, Decision making under uncertainty and risk. Asymmetric Information: Adverse Selection and Moral Hazard. Theory of Agency costs. The Theory of Search, Non-Cooperative games: Constant sum game, Mixed Strategy & Pure Strategy, Bayesian Nash Equilibrium, SPNE, Perfect Bayesian Equilibria., Theory of Firm: Market Structures Competitive and Non-competitive equilibria and their efficiency properties. Structure-Conduct-Performance Paradigm, Factor Pricing: Marginal productivity Theory of Distribution in Perfectly Competitive markets; Theory of Employment in Imperfectly Competitive Markets – Monopolistic Exploitation, General Equilibrium Analysis. Welfare Economics: Fundamental Theorems, Social Welfare Function. Efficiency Criteria: Pareto-Optimality |

C1.2 Macroeconomics |

National Income Accounting: Closed Economy Concepts and Measurement and Open Economy Issues, Determination of output and employment: Classical & Keynesian Framework, Theories of Consumption: Absolute Income Hypothesis, Relative Income Hypothesis, Life Cycle Hypothesis, Permanent Income Hypothesis and Robert Hall’s Random Walk Model; Investment Function Specifications – Dale Jorgenson’s Neoclassical Theory of Capital Accumulation and Tobin’s, Keynesian Stabilization Policies, (Autonomous) Multipliers and Investment Accelerator, Demand and Supply of Money, Components of Money Supply, Liquidity Preference and Liquidity Trap, Money Multiplier, Interest Rate determination, Central Banking, Objectives, Instruments (Direct and Indirect) of Monetary Policy, Prudential Regulation, Quantitative Easing (Unconventional Monetary Policy), Commercial Banking, Non-Banking Financial Institutions, Capital Market and its Regulation, Theories of Inflation and Expectations Augmented Phillips Curve, Real Business Cycles, Adaptive Expectations Hypothesis, Rational Expectation Hypothesis and its critique. Closed Economy IS-LM Model and Mundell Fleming Model: Monetary and Fiscal Policy Efficacy. The Impossible Trinity. |

C1.3 Statistics, Econometrics and Mathematical Economics: |

Probability Theory: Concepts of probability, Probability Distributions [Discrete and Continuous), Central Limit Theorem, Index Numbers and Construction of Price Indices, Sampling Methods & Sampling Distribution, Statistical Inferences, Hypothesis Testing, Linear Regression Models and the Gauss Markov Theorem, Heteroscedasticity, Multicollinearity and Autocorrelation, Spurious regressions and Unit roots, Simultaneous Equation Models – recursive and non-recursive. Identification Problem, Differential Calculus and its Applications, Linear Algebra – Matrices, Applications of Cramer’s Rule, Static Optimization Problems and Applications, Input-Output Model, Linear Programming, Difference equations and Differential equations with applications |

C1.4 International Economics: |

Theories of International Trade, International Trade under Imperfect Competition, Gains from Trade, Terms of Trade, Trade Multiplier, Tariff and Non-Tariff barriers to trade; Dumping and Anti-Dumping Policies, GATT, WTO and Regional Trade Blocks; Trade Policy Issues, Balance of Payments: Composition, Equilibrium and Disequilibrium and Adjustment Mechanisms, Foreign Exchange Market and Arbitrage, Exchange rate determination, IMF & World Bank. |

C1.5 Public Economics: |

Market Failure and Remedial Measures: Asymmetric Information, Public Goods, Externality, Regulation of Market – Collusion and Consumers’ Welfare, Public Revenue: Tax & Non-Tax Revenue, Direct & Indirect Taxes, Progressive and non-Progressive Taxation, Incidence and Effects of Taxation, Public expenditure, Public Debt and its management, Public Budget and Budget Multiplier, Tax Incidence, Fiscal Policy and its implications, Environment as a Public Good, Market Failure and Coase Theorem, Cost-Benefit Analysis. |

C1.6 Development Economics: |

Theories of Economic Development: Adam Smith, David Ricardo, Karl Marx, J. Schumpeter, W. Rostow, Balanced & Unbalanced Growth, Big Push Approach, Indicators of Economic Development: HDI, SDGs, MDGs, Poverty and Inequalities – Concepts and Measurement Issues, Social Sector Development: Health, Education, Gender, Fertility, Morbidity, Mortality, Migration, Child Labor, Age Structure, Demographic Dividend, Models of Economic Growth: Harrod-Domar, Solow, Ramsey, Technical progress – Disembodied & Embodied, Endogenous Growth Models. |

C1.7 Indian Economy: |

Economic Growth in India: Pattern and Structure, Agriculture, Industry & Services Sector: Pattern & Structure of Growth, Major Challenges, Policy Responses, Rural & Urban Development – Issues, Challenges & Policy Responses, Flow of Foreign Capital, Trade Policies, Infrastructure Development: Physical and Social; Public-Private Partnerships, Reforms in Land, Labour and Capital Markets, Poverty, Inequality & Unemployment, Functioning of Monetary Policy in India, Fiscal Policy in the Indian context: Structure of Receipts and Expenditure, Tax reforms- Goods and Services Tax, Issues of Growth and Equity, Fiscal Federalism, Centre-State Financial Relations and Finance Commissions of India; Sustainability of Deficits and Debt, The Fiscal Responsibility and Budget Management Act 2003, Demonetization and aftermath. India’s balance of payments, Composition of India’s Trade, Competitiveness of India’s exports, India’s exchange rate policy. |

Class Timings

|

EduSure Blogs

Job Opportunities

after Masters in Economics

Consultancy Roles

Graduates can work as economic consultants, providing valuable insights to businesses, government agencies, private sector or non-profit organizations.

Data Science and Analysis

With strong analytical skills, economics graduates are well-suited for roles in data science, where they analyze and interpret complex datasets.

Finance and Banking

Opportunities abound in the financial sector, including roles in banking, investment analysis, or financial consulting.

Policy Analysis

Graduates can engage in policy analysis, working with government bodies or policy think tanks to shape and evaluate economic policies.

Academia

Teaching and research positions in universities or colleges offer a fulfilling path for those interested in imparting knowledge and contributing to academic advancements.

Research Positions

Many pursue careers in research, contributing to academic institutions, think tanks, or research organizations.

International Organizations

Organizations like the World Bank, IMF, and UN provides opportunities for economists to work on global economic issues.

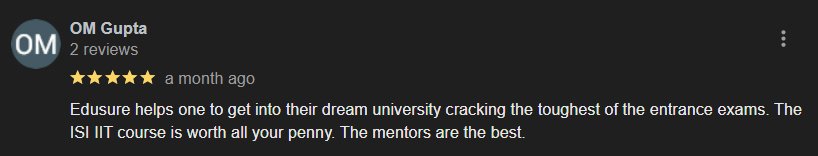

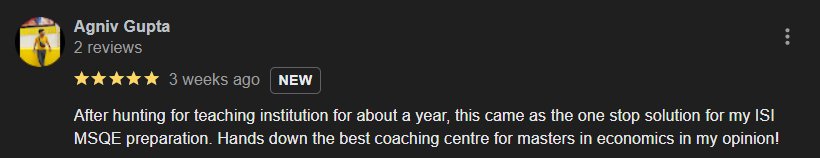

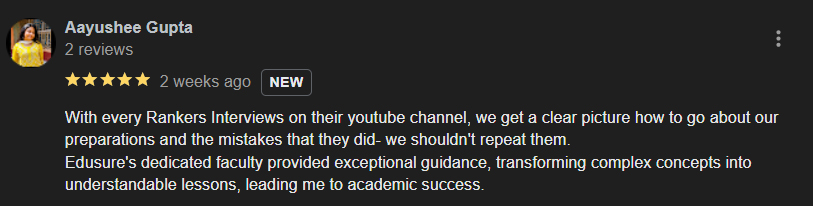

IIT GATE Successful Students by EduSure

Be a part of the journey that thousands of students have embarked on to fulfill their dreams.

0

Above Number of Students Placed

0